Printech comments on the legality of positive pay software

In a summary judgment rendered July 14, 2010 by the U.S. District Court of Minnesota, Wachovia Bank (NYSE: WFC) was found not liable for a fraudulently-altered check drawn on the bank. The bank’s client had failed to implement positive pay software services recommended by the bank which would have prevented payment of the check.

Printech Global aided the defense on the case, and CheckPlusCFO Positive Pay software was cited as a low-cost Positive Pay software option.

Check Fraud Case Background

On December 1, 2005, a Wachovia Bank client was scammed by a group from South Africa and issued a check in the amount of $153,856.46. The payee wired the money and kept $3,500 for the transaction that seemed to be legitimate. In January 2006, the bank’s client detected and reported the fraud to Wachovia, demanding a refund to their account.

On December 1, 2005, a Wachovia Bank client was scammed by a group from South Africa and issued a check in the amount of $153,856.46. The payee wired the money and kept $3,500 for the transaction that seemed to be legitimate. In January 2006, the bank’s client detected and reported the fraud to Wachovia, demanding a refund to their account.

Grounds for the Legal Ruling

Court records show that the client contended that Wachovia should bear the loss because the altered check. Banks and clients can agree to a different rule in the bank’s depository agreement with the client, per Section 4-103(a) of the UCC. The requirement for the depository agreement states that the agreement “cannot disclaim the responsibility of a bank for its lack of good faith or failure to exercise ordinary care.”

Court records show that the client acknowledged that Wachovia had made Positive Pay software available to them and that it would have detected the fraudulently-altered check. At the end it was established that Wachovia acted reasonably in requiring the client to utilize Positive Pay software from both an implementation and total-cost-of-ownership perspective. Printech Global acknowledges that it is unfortunate that the client mistakenly thought it would cost tens of thousands of dollars to implement Positive Pay software. It could have been installed on existing computers for significantly less money.

… Wachovia’s depository agreement clearly provided that if the client declined to implement Wachovia’s “Positive Pay” fraud-deterrence program that the client could not hold Wachovia liable for subsequent check fraud losses.

Positive Pay Software by Printech

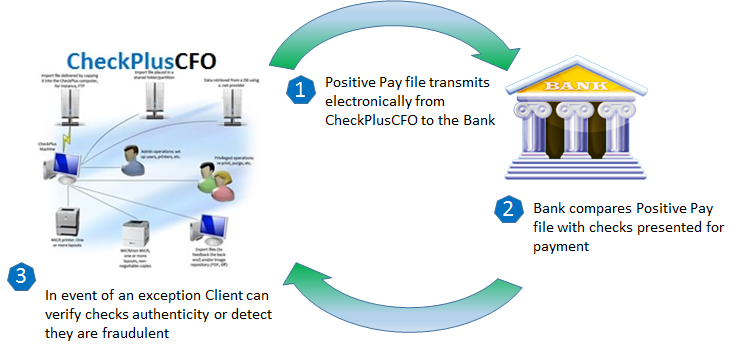

Positive Pay software reporting allows a customer to generate and transmit a file to their bank referencing the checks that have been issued with the CheckPlusCFO check printing software. The bank then takes responsibility to cash only those checks referenced in the Positive Pay file.

It is clear from the court’s decision that banks and businesses must both do their part to prevent check fraud and avoid losses. Banks that are exercising “ordinary care” by offering Positive Pay software services and products such as CheckPlusCFO Positive Pay software to their clients can potentially avoid liability for subsequent check fraud. Businesses that cost-effectively implement Positive Pay using CheckPlusCFO software will meet bank requirements to avoid check fraud liability. They will also establish an effective partnership with their bank to stop check fraud and make the real criminal liable for their crime.

Contact us to speak with our in-house software consultant and see how your company can benefit from positive pay automation.